As sales slow, what will help the housing market?

It’s becoming clear that buyers aren’t as eager to buy a home as they were a few months ago. More sellers are putting their homes on the market, but there are fewer multiple offers, fewer homes selling at or above list price, and existing homes at all price points are taking longer to sell.

On top of that, there are fewer new-construction homes being sold. According to housing economists, it’s likely that fewer than 650,000 newly built homes will be sold in 2025. That’s only about twice as many new homes sold as in the depths of the housing crisis some 15 years ago.

At the recent National Association of Real Estate Editors (NAREE) annual conference in New Orleans, housing experts and real estate reporters discussed why the slowdown in real estate was happening.

There was wide consensus that higher interest rates combined with ever-higher housing prices have curtailed buyer enthusiasm to a degree. With interest rates hovering around 6.8%, homes are simply less affordable to a large swath of the population. According to Redfin, the real estate brokerage company, there are two main reasons for the slowdown: First, housing costs are still soaring, with home-sale prices up 1.6% year over year to a record high and mortgage rates sitting near 7%; and, many would-be buyers are holding off due to widespread economic uncertainty and recession jitters.

It didn’t help that this week the Bureau of Economic Analysis (BEA) announced real gross domestic product (GDP) decreased at an annual rate of 0.5% in the first quarter of 2025 (January, February and March), according to the third estimate. In the fourth quarter of 2025 (October, November and December), real GDP was 2.4%. That’s a downward swing of nearly 3%, and supports the idea that buyers may indeed be jittery.

But don’t discount rising prices. According to the Census Bureau, the average sales price of new houses sold in May 2025 was $522,200.

How much money do you need to earn to afford to buy a home for $522,000? If you put down 20%, that’s $104,000 in cash you need to avoid paying private mortgage insurance, a large chunk of savings that many first-time home buyers simply don’t have. Plus you also need three months’ of cash reserves and some cash to actually move into your new home.

But after your down payment, you’ll still need a mortgage of $418,000. To comfortably afford that mortgage, you’ll need an income between $100,000 to $125,000 per year. The median family income for a family of four is around $119,000 according to the Census Bureau. But if you dig down into the state data, the median household income for that same family of four varies from $96,161 in West Virginia to $159,676 in Connecticut. The average price of a home varies, too, but buyers don’t want to purchase a home and then find out they can’t afford the insurance, maintenance and upkeep that goes along with it.

So, what will help the housing market? Lower interest rates could help make homes more affordable, until competition for those homes heats up again and prices rise. Unfortunately, the Mortgage Bankers Association’s new forecast calls for rates to decline only slightly to 6.7% by the end of 2025. Jerome Powell, President of the Federal Reserve Bank, has indicated he’ll only lower interest rates once he is confident inflation is contained.

Home builders could build more homes, but the homes they have already built aren’t selling well. That could change quickly with lower interest rates, but the price of a new home would still be sky high. There is a movement brewing to push for changes in local zoning laws to allow smaller new homes to be built.

At NAREE, housing experts discussed that many counties have zoning laws that require new homes to be built that are at least 2,500 square feet. With the cost of building a standard new home at around $200 per square foot, building smaller homes could lower the price point significantly and make new homes more affordable.

Raw materials are subject to tariffs, which is also contributing to rising prices, as is a shortage of materials for both building new homes and renovating existing homes.

Finally, there was some discussion at the conference about who is actually going to be building and renovating all of these homes. The housing industry remains concerned about the lack of skilled foreign workers coming into the country. Immigrants have long brought homebuilding skills to the housing industry. Without them, builders are paying more to their employees and subcontractors, which is also contributing to the rising price of a new home.

========

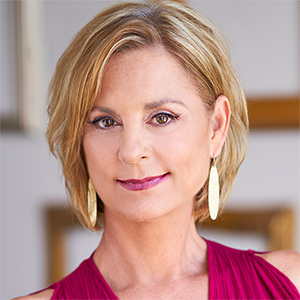

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments