Unmarried, unrelated couples buying a home should consider various options for home ownership

Q: As a real estate attorney, I am concerned when unrelated persons, even engaged couples, purchase real estate together. In many cases, I find these clients have not considered the various options for ownership of the property they want to buy.

I tell my clients to choose a limited liability company, corporation, partnership, or joint tenancy, or tenancy in common. I also find that most do not have a written operating agreement that specifies who pays what, how decisions will be made regarding repairs, how/when money is put into upgrades, who lives in the property or what the rental parameters will be, and who has the power to force a sale.

I wonder if other attorneys see the same issues with their real estate clients.

A: Yes. They do. We agree that unmarried co-buyers often don’t understand the choices they have when it comes to thinking through the various ownership options. Sam has provided the same information to his clients through the years, but there is still some confusion about which is the right way to go and what each choice may mean over the short and long term.

At the very basic level, you may decide to own a home as joint tenants with rights of survivorship or as tenants in common. With joint tenants with rights of survivorship, the survivor becomes the owner of the home upon the death of the co-owner. With tenancy in common situations, upon the death of one owner, that owner’s share would go to their heirs or according to the wishes as set forth in their will. The share will not flow automatically to the co-owner unless specified in writing in a will, or other document.

But that only takes care of the issue of when a person dies. More commonly, people break up. Married people start the divorce proceedings, and if they can’t work it out, the judge will ultimately decide how assets get handled. It’s better if the buyers make the decision about how a property will be divided rather than leaving it up to a judge or mediator.

Sam also commonly sees a situation where friends or family members buy a home or vacation property together. It’s fine, until it’s not. Over the years we have received so many letters about siblings that can’t get along with each other. Or parents that decide to stay and live in a home they don’t own. Friends or partners that decide to buy a big home and live together, until someone has a change in life circumstance, gets a new job, or decides they just want a ski house instead of a beach house — and then they can’t figure out who paid for what and how to divide the asset.

At a minimum, we would like to see people who buy homes together have a written document that addresses the following:

These are only some of the questions and issues you need to address when you co-own a home. Of course, when things go well and the owners share equally in all expenses and never have real issues relating to the ownership, there’s no need to worry.

But friendships sour, people grow apart or die, and relationships change. People lose jobs, take jobs in other cities, or resign to become a caregiver, parent, or because they themselves are incapacitated. You might get hit by a bus, and then everything changes. In any of these cases, co-owned property might no longer work for one of the owners.

There are so many different reasons co-owners split up. But when it happens, the co-owners’ interest in owning and living in the home may change. If and when it does, or a disagreement pops up, you’ll be glad to have a document that spells things out.

It’s said that good fences make good neighbors. We think good documentation makes for good co-owners.

========

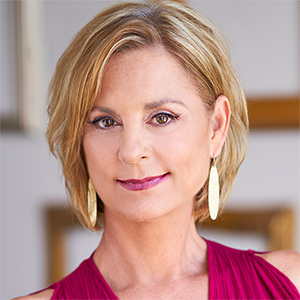

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments