The bond market's favorite recession signal is on the fritz

Published in Business News

The bond market hasn’t rung false recession alarms for this long in at least half a century.

By Monday, it will be three full years since the market’s movements started suggesting a U.S. downturn was on the horizon. That’s when 3-month Treasury yields first pushed above 10-year ones — inverting the yield curve — as traders anticipated the Federal Reserve’s steep interest-rate hikes would stall the economy.

That sort of inversion telegraphs that rates are expected to come down in the years ahead, once growth finally snaps, and it has been a harbinger of the last eight recessions. Yet this time around the economy has kept powering through for 36 months. It’s the longest wait since at least the late 1960s, surpassing the 22-month lag between the bond market’s warning sign and the onset of the Great Recession unleashed by the housing crash.

Since emerging from the pandemic, the U.S. has weathered one shock after another: Surging inflation, the Fed’s aggressive policy tightening, a regional banking crisis, the U.S.-against-the-world trade war, and now a government shutdown.

But it has continued to defy doomsayers. The Atlanta Fed’s GDPNow model currently estimates that the economy is expanding at an annualized pace of nearly 4%. The Fed is expected to give it a boost by enacting another quarter-point rate cut after its next meeting Wednesday.

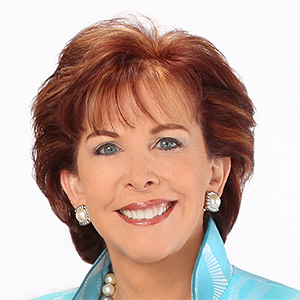

Campbell Harvey — the Duke University professor who first identified the yield curve’s predictive power in the 1980s — concedes that this cycle may be so different that the bond-market metric may be sounding a false alarm. In addition to the healthy finances of consumers and corporations, as well as the artificial-intelligence investment boom, there’s been a splurge of government spending that has defied precedent.

“Massive fiscal spending – that’s so different historically,” he said. “That’s fairly unusual.”

Typically, recessions follow an inversion by about 11 months on average. The current episode began at the end of October 2022. By May 2023, after the collapse of Silicon Valley Bank sowed fears of a full-blown credit crisis, 10-year Treasury yields dropped to more than 1.8 percentage points below 3-month rates, the most since 1981.

The curve finally returned to a slightly positive slope in December, after the Fed began easing policy. That movement too usually signals that the long awaited downturn is imminent — since short-term rates come down rapidly when the central bank starts trying to jumpstart growth again. But that was offbase, as well. The Fed stopped cutting rates as 2025 began and didn’t resume doing so again until last month because the economy — and inflation — continued to surprise to the upside.

“The yield curve predicted the last eight recessions,” Harvey said. “At some point it’s going to deliver a false signal. But eight out of nine is pretty good.”

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments