Nevada-inspired 'no tax on tips' policy coming to fruition after 'big, beautiful' bill passes

Published in Political News

No taxes on tips and overtime will likely come to fruition as a major tax policy heads to President Donald Trump’s desk.

The House of Representatives voted 218-214 to approve Trump’s $4.5 trillion tax breaks and spending cuts bill known as the “big beautiful bill” on Thursday after months of negotiations and opposition from Democrats. Trump is expected to sign the bill Friday at 2 p.m.

The legislation, over 800 pages long, makes sweeping policy changes, including extending Trump’s tax cuts from 2017 and eliminating taxes on cash tips and overtime, completing a major campaign promise of Trump, who first pitched no taxes on tips during a Las Vegas rally.

Federal income tax on cash tips will be deducted up to $25,000 during a taxable year for a period of four years, meaning tips could again be taxed after 2028.

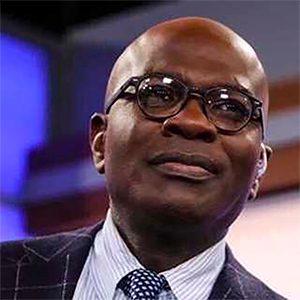

Rep. Steven Horsford, D-Nev., introduced amendments to the package to make no tax on tips permanent and define the words “tip” and “tipped work” in an effort to prevent loopholes in the law, but his amendments were unsuccessful.

The White House’s Council of Economic Advisers estimates that no tax on tips will increase the average take-home pay for tipped workers by $1,675 per year.

Nevada’s Democratic members of Congress roundly criticized the bill, saying it will have a harmful impact on access to health care and will add between $3 trillion and $5 trillion to the national debt by making the 2017 tax cuts permanent, though the White House has said economic growth spurred by the bill will actually reduce the national debt.

“There is no spin for the human suffering they’re causing,” Horsford said in a statement. “This is Robinhood in reverse, and Republicans would be wise to remember that they won’t have the last word here – the American people will, on Election Day.”

Earlier this week Sen. Catherine Cortez Masto, D-Nev., joined Nevada health care organizations in highlighting adverse impacts on health care. Those impacts include 70,000 Nevadans being kicked off Medicaid and 40,000 losing their coverage under the Affordable Care Act, according to Cortez Masto.

Jennifer Wakem, chief financial officer of University Medical Center, Nevada’s only public hospital, said it relies heavily on Medicaid. To stay afloat financially, the hospital will potentially cut services or reach out to the county for additional subsidies to keep services open, she said.

Republicans, however, say that without this bill, the average taxpayer would see a 22 percent tax hike.

“The House of Representatives delivered on its promise to rein in out-of-control spending, unleash American energy dominance, drive economic growth, and secure our borders after 4 years of mismanagement under the previous administration,” said Rep. Mark Amodei, R-Nev., in a statement.

Besides implementing no taxes on tips, the reconciliation bill also includes provisions to eliminate taxes on overtime pay, not exceeding $12,500 or $25,000 in the case of a joint return. It also eliminates taxes on car loan interests from 2025 through 2028.

___

©2025 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments