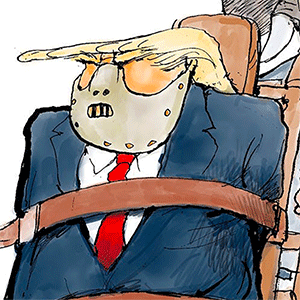

House shouldn't dither on Trump's signature legislation

Published in Political News

The pursuit of perfection is politics is a fool’s game, and so it is with President Donald Trump’s “big, beautiful bill.” The sausage-making in the Senate wasn’t pretty — some positive provisions, including federal land sales, were sent to the shredder — but the upper chamber approved the legislation Tuesday, moving the White House one step closer to delivering on a slew of campaign promises.

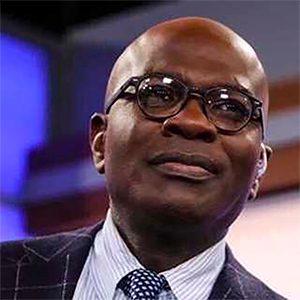

It was the narrowest of margins in the Senate, 51-50, with Republicans needing Vice President JD Vance to cast the tie-breaking vote. The House version passed in May also by a lone vote, 215-214. Speaker Mike Johnson and Senate Majority Leader John Thune have deftly navigated a difficult political landscape. But challenges remain.

The measure must now go back to the House — and any changes made would require another vote in the Senate. Some GOP House members will object to changes made to secure the necessary support in the upper chamber, but they must accept political reality. Compromise is the only way forward given the slim Republican majorities. The margin for error is nonexistent.

The bill that emerged from the Senate has flaws — it increases the deduction for state and local taxes, a subsidy for the wealthy in big-spending blue states, and it waters down Medicaid reforms — but it includes many worthwhile initiatives. Foremost among them is an extension of Trump’s 2017 tax reform. The failure to make that legislation permanent would impose a $4 trillion tax hike on Americans and the economy, the largest in history. Even many Democrats aren’t eager to embrace such a massive government money grab.

Nevada hospitality workers will benefit from the bill’s language regarding tip income, one of Trump’s most high-profile campaign pledges. According to The Wall Street Journal, the Senate legislation would for the next three years allow people making less than $150,000 a year in certain jobs to deduct up to $25,000 worth of tips from their income tax obligations and up to $12,500 in overtime pay.

Other positive aspects of the Senate version include pulling the plug on many taxpayer handouts for green energy interests and wealthy EV buyers and implementing work requirements for able-bodied adults on Medicaid while imposing “more frequent eligibility checks for enrollees,” the Journal reported.

As for Democrats raising a stink about Medicaid “cuts,” that’s fake news. Spending on the entitlement program will increase for the length of the bill, albeit at a lower rate than currently projected. Similarly, for Democrats whining about the debt and deficits, Washington has a spending problem, not a revenue shortage. Pro-growth policies such as tax and regulatory reform will help address the red ink.

House Republicans shouldn’t dither over minute differences. Send the measure to Trump.

©2025 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments