Michigan's congressional delegation braces for 'big beautiful bill' battle

Published in Political News

WASHINGTON — Michigan Democrats criticized the Senate's changes to President Donald Trump's massive tax and border bill as it returned Wednesday to the House, where the state's Republican lawmakers were working to bring it home ahead of the Independence Day holiday on Friday.

"The bill is President Trump's agenda, and we are making it law," Michigan Rep. Lisa McClain, chair of the House GOP Conference, said in a joint statement with House Speaker Mike Johnson of Louisiana. "House Republicans are ready to finish the job ..."

House lawmakers rushed back to Washington after the GOP-led Senate voted 51-50 along party lines Tuesday to pass the One Big Beautiful Bill, the cornerstone of President Donald Trump's second-term agenda. Democrats and some GOP lawmakers opposed to the bill forced procedural delays into Wednesday afternoon.

The massive package extends and increases expiring GOP tax cuts and boosts spending on immigration enforcement and the military. It's paid for by slashing federal spending on the social safety net in terms of Medicaid and food stamps ― largely by work requirements on able-bodied people ― placing new limits on student loans and axing subsidies for clean energy, including electric vehicles, wind and solar.

"The president is absolutely right that we've got to pass this to make sure that the landmark legislation regarding our tax policy is put in place, so that we can be competitive around the world," said Rep. Bill Huizenga, a Holland Republican.

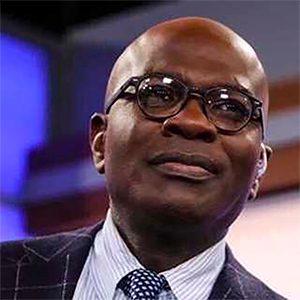

But Democratic Sen. Gary Peters, after a 24-hour-plus Senate marathon voting session, predicted the legislation would play out "very badly" for hundreds of thousands of people in Michigan at risk of losing healthcare coverage or food aid.

"My heart breaks for all the people who are going to be losing healthcare for a bill that basically just gives huge tax breaks to the wealthiest people in the country and, at the same time, piles on $4 trillion of debt," Peters told The Detroit News.

"That's going to increase interest rates for folks who want to buy a car or take a mortgage out on their home. It's going to make life more expensive for folks, and it's going to put our country into an increasingly precarious financial situation."

Both sides predicted electoral consequences for their opponents as a result of the legislation: The White House criticized Democrats for unanimously voting against lower taxes, while Democrats said voters would hold Republicans accountable for gutting healthcare for as many as 17 million Americans.

Back in Michigan, Gov. Gretchen Whitmer took the unusual step of publicly urging Michigan's delegation to vote no, saying the bill would cost thousands of jobs, increase hunger and kick 120,000 Michiganians off their Healthy Michigan healthcare plans due to the expiration of the federal Affordable Care Act's enhanced premium tax credits.

Her administration has estimated that the bill's limits on state financing of Medicaid and reimbursement rates for providers would cause a $2.5 billion hit to Michigan hospitals and doctors, and that new Medicaid work requirements would lead to 290,000 Health Michigan participants losing coverage. A new state cost share for the Supplemental Nutrition Assistance Program, also called food stamps, could potentially cost the state another $312 million, starting in 2028.

"We cannot backfill the massive hole in our budget that this budget will cause with state funding alone," Whitmer said.

Medicaid changes

Rep. Tom Barrett, a Charlotte Republican, was working through the Senate changes Wednesday, including revisions to the Medicaid provisions, but said he was "definitely leaning" toward voting for the bill.

"What the bill is intended to do is to provide the tax certainty that we need, which this does, and to provide the border security that Americans are desperately in favor of," Barrett said. "So the two biggest domestic policy agenda items are in there that people voted for last year."

Speaker Johnson said he intends to pass the Senate bill as is and won't touch some of the substantial changes that senators made up to the last minute Tuesday; however, divergent segments of his conference were complaining about elements on the legislation Wednesday, with far-right lawmakers objecting to the Senate bill's larger deficit impact.

The Senate's changes include the addition of a $50 billion fund to help compensate rural hospitals for some of the funding they'd lose as a result of Medicaid cuts in the legislation. GOP senators doubled the amount of the fund from $25 billion and moved up the timeline for the money to be distributed to start in 2026.

Rural hospitals in Michigan ― which have higher shares of low-income patients on Medicaid ― are expected to get hit especially hard due to the Senate's shrinking states' use of provider taxes from a safe-harbor threshold of 6% to 3.5% by 2031. Every state but Alaska imposes provider taxes to help finance the state share of Medicaid costs.

The Michigan Health & Hospital Association last month estimated that hospitals in the state would lose conservatively $1 billion as a result of the provision, and said facilities would likely reduce services and staff or even shut their doors.

That figure doesn't account for a projected spike in uncompensated care that hospitals would encounter due to coverage losses as a result of other provisions in the legislation, such as expanded Medicaid work requirements and twice-annual eligibility assessments for Medicaid participants.

Michigan Democratic Sens. Peters and Elissa Slotkin of Holly both voted against an amendment put forward by Maine GOP Sen. Susan Collins to create the $50 billion rural hospital fund, with Peters calling the amount a "pittance."

"A lot of rural hospitals in Michigan are really concerned, and some of them believe that they may not survive," Peters said. "The amount that was in that amendment wasn't going to make a difference. I'm tired of political gimmicks, and that's exactly what that amendment was."

Rep. John Moolenaar, a Caledonia Republican whose district includes several rural hospitals, was glad to see the addition of the fund, which he noted covers five years.

"To me, that's an important focus on rural health care, and I support that," Moolenaar said.

Barrett also had heard the hospitals' concerns but contended that the industry would be opposed to any Medicaid reforms put forward by Congress. He sides with the view that provider taxes allow states to abuse the system without putting forward a true cost share in the program.

He also believes that the projections of hundreds of thousands of people losing coverage are exaggerated.

"It's certainly our intent to preserve Medicaid for people who are the vulnerable populations that should be eligible for Medicaid coverage, without covering people that are in the country illegally, without covering people that are able bodied and not working and people who are duplicatively enrolled or ineligible because they didn't qualify in the first place," Barrett said.

"Those are all reforms that I think are valid."

Senate revisions

The Senate's bill softened the House's cost-share provision for the federal food assistance program called SNAP and would, starting in 2028, require states to shoulder up to 15% of the SNAP program's benefit costs.

Each state's share is based on how efficiently they administer their SNAP program. Michigan's latest payment error rate, published by the U.S. Department of Agriculture on Monday, hovers just below 10%.

At that level, Michigan would be responsible for 10% or $311.5 million of SNAP benefits in Michigan, where low-income households are on track to qualify for $3.1 billion in annual benefits in 2025.

Rep. Kristen McDonald Rivet, a Bay City Democrat, said the Senate returned the bill to the House worse than when it left. It would still take food from hungry kids, cost families their healthcare and raise utility costs, she said.

"The phone is off the hook in both our district offices and here in DC, about particularly the cuts to Medicaid. People are awake and watching what Congress is doing right now, which, honestly, I think is pretty rare," she said.

"Even though they tried to delay some of these cuts, some of the things are going to start to go into effect immediately. People know it's coming, and I think that this is the thing that will cost Republicans the majority in the House."

GOP senators did ax some provisions at the last minute including a green energy excise tax but maintained the push to unwind clean-energy tax credits.

The Electrification Coalition, an advocacy group, urged the House to change the Senate bill and "reject" the elimination of EV tax credits, saying the move "jeopardizes $157 billion of investments and hundreds of thousands of American manufacturing jobs."

The Alliance for Automotive Innovation, a lobby group representing all major U.S. automakers except for Tesla Inc., said the Senate's accelerated credit phaseout to September of this year will be "extremely challenging" to EV adoption but also cheered the Senate's decision not to impose new fees on EVs and batteries.

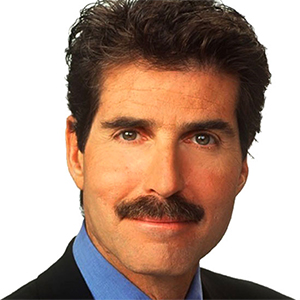

Alliance President and CEO John Bozzella also praised the Senate revisions to language on a battery production tax credit, saying the chamber recognized the credit is working by bringing battery manufacturing back to the U.S.

"By restoring the workability of this key credit and maintaining prohibitions against Chinese companies from credit eligibility, senators preserved billions in auto-related manufacturing investments and jobs," Bozzella said.

Moolenaar saw his NO GOTION measure retained in the Senate legislation to prohibit companies affiliated with the Chinese Communist Party from qualifying for green energy production tax credits. The measure is named for the Gotion battery plant project in the Big Rapids area that the congressman has long opposed.

Moolenaar also said the Senate's language appears to give Ford Motor Co. time to reduce its reliance on companies affiliated with China in relation to the automaker's $3 billion investment in a battery plant in Marshall.

"The bottom line is we don't want to further our dependence on companies affiliated with the Chinese Communist Party, who are partnering with their military or using forced labor," Moolenaar said.

The Senate retained the bill's federal school voucher program, though it's different than the House's take. Long a goal of former Education Secretary Betsy DeVos, taxpayers could claim a federal tax credit for donations to organizations that provide scholarships for students to attend private schools.

The provision effectively would have brought vouchers to Michigan for the first time. The state's Blaine Amendment constitutionally prohibits using state dollars to support any non-public school; however, a revision by the Senate allows states to opt out of participating and gives states the ability to impose regulations on the voucher providers.

Left out of the Senate bill was funds for a Great Lakes heavy icebreaker ― something that had been included in the House version of the legislation.

Huizenga, co-chair of the House Great Lakes Task Force, had written to Senate leaders last week, joined by several Michigan GOP colleagues, urging them to add supportive language back in. It didn't materialize.

Constituent stories

Both parties evoked constituent stories in recent days to make their case for and against the so-called One Big Beautiful Bill.

McClain brought a small businessman from her district, Sam Palmeter of Laser Marking Technologies in Caro, to Washington to explain how his company would benefit from the bill, particularly an increase in the pass-through deduction for small businesses to 23%.

Palmeter said his business is one of two laser technology companies fully owned and operated in the U.S., warning that foreign companies are buying out his competitors. The tax provision will allow his business to invest in additional manufacturing space, which juices the local economy, he said.

"And no taxes on overtime is great for my employees," Palmeter added.

U.S. Rep. Debbie Dingell, D-Ann Arbor, also evoked the stories of Michigan residents who would be affected by the Medicaid cuts when she carried copies of 15,000 of their letters to enter them into the official record at a Tuesday night meeting of the House Rules Committee.

Dingell recounted the story of one mother she ran into inside an elevator at the University of Michigan, who was with her son, who uses a wheelchair. The mother burst into tears as she told Dingell she was terrified of her child losing his Medicaid coverage, she said.

"'My child's going to die if they take this away,'" Dingell recalled her saying.

"These are human lives. The human faces behind the stories."

_____

Staff Writer Grant Schwab contributed.

_____

©2025 The Detroit News. Visit detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments