Jill On Money: Mid-year money moves

Wars! Tariffs! DOGE! The Fed! Interest rates! We are just six months into the year and if you are feeling overwhelmed by the news flow, it’s time to address something over which you have some control: your money.

Here are six steps to help you make some smart money moves:

Review your spending from the first half of the year. If you aren’t using an app, pull bank statements and credit card bills and you might discover that returning to an office five days a week has meant too many lunches out. Or that your streaming services now cost more than that cable bundle that you abandoned.

The goal is to identify some spending that can be redirected towards saving and/or paying down debt.

These nefarious fees are designed either to confuse or deceive consumers. Although some rules have been enacted, with the near-elimination of the CFPB, it’s hard to imagine that consumer-facing infractions will garner much attention.

That means the onus is on all of us to keep up our guard on everything from bank fees, credit card late payment fees, hotel resort fees, airline baggage and change fees, service and cable fees. To defend yourself, methodically review the categories of spending where they usually pop up.

Life changes, and so should your insurance. Got married/divorced? Had a baby? Received a new diagnosis? Bought a house? Many of these milestones impact your health, auto, home, and life insurance.

Of particular focus should be home/renters’ coverage as well as car insurance. These two categories have skyrocketed since the pandemic, with auto insurance up by more than 50 percent since 2020 (BLS) and home insurance premiums soaring by 24% in three years (Consumer Federation of America).

To defray some of the increase, shop around, consider bundling coverage, educate yourself on ways to qualify for a discount (security systems, paying for a full year vs. monthly, take a defensive driving course), and consider dropping collision and/or comprehensive coverages on older cars.

It’s been three years since interest rates peaked and yet many savers are still sitting in accounts that are earning peanuts.

Scour the internet and/or ask for higher yielding safe money accounts from the institutions with whom you do business. In many instances, if you don’t ask, you don’t get!

If you have multiple retirement accounts, try to combine them to make it easier to monitor, manage, and rebalance them. If you have a good workplace plan, you may be able to roll old retirement accounts in; otherwise, you can simply choose the financial institution that has a user-friendly platform.

Wherever you keep your accounts, be sure to rebalance them once or twice a year. Rebalancing is the action that keeps your desired allocation in check – and it often results in selling some of what's performed well and buying more of what's lagged, essentially buying low and selling high.

If your cash flow allows, consider boosting your retirement savings. The employer-based plan contribution limit for 2025 is $23,500, plus an additional $7,500 if you're 50 or older. Even a one percent increase in your contribution rate can make a significant difference over time, thanks to compound growth.

What would a mid-year update be without me nudging you to prepare/update your will, power of attorney, and health care proxy? If you don’t want to hire a qualified estate attorney, there are plenty of online choices.

_____

_____

========

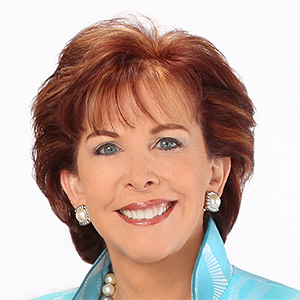

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments