Moderna chair says US assault on science is just beginning

Published in Business News

Moderna Inc.’s chairman says the Trump administration’s vaccine policy changes are part of a broader attack on science that may have only just begun.

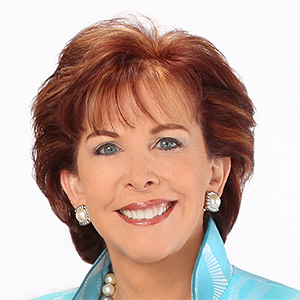

“Today it may be childhood vaccines or mRNA, but tomorrow it’s everything,” Noubar Afeyan said in an interview Monday on the sidelines of the JPMorgan Healthcare Conference in San Francisco. “We have to say not just ‘why is this happening?’ but ‘where will it stop?’”

Afeyan, a cofounder of Moderna, said he was worried that not enough people are connecting the dots between the Trump administration’s new vaccine restrictions and other moves by U.S. officials, like cuts to National Institutes of Health funding.

“Vaccines are just another form of medicine,” he said. “People want to create some separate category. To me, it’s nonsense. The same science that brought you a way to delay or prevent a disease or lessen its impact is the exact same science that you took for your cancer treatment or your obesity drug.”

“I do not accept the premise this has anything to do with vaccines,” added Afeyan, who also founded Flagship Pioneering, which invests in and creates new biotech companies. “This is much broader than that.”

In his annual letter, published Monday, Afeyan said the U.S. could still turn things around by restoring funding for scientific research, fixing visa policies that have made it harder to attract top international scientists and other steps.

Moderna has struggled in recent years as the end of the pandemic has led to a long decline for its COVID-19 business. U.S. officials have made things even harder for the company, narrowing the population of people who are eligible for COVID-19 vaccines, creating confusion over how to get them and raising questions over their safety.

The number of people in the U.S. getting COVID-19 shots fell 26% in 2025, according to Chief Financial Officer Jamey Mock. That’s smaller than a drop of as much as 40% the company had expected. As a result, Moderna generated 2025 revenue of about $1.9 billion, up $100 million from the midpoint of its previous guidance and in line with analysts’ expectations.

“The U.S. performed well,” Mock said in an interview.

The results are a sign that Moderna’s business could be starting to stabilize. The company reiterated its plan to deliver up to 10% revenue growth in 2026.

Moderna shares fell 1.3% in New York on Monday. The shares lost 29% in 2025 but had gained 16% this year through Friday’s close.

The company has responded to dwindling demand for COVID-19 shots by aggressively cutting costs, chasing growth outside the U.S. and recently securing a loan for up to $1.5 billion.

The money-losing vaccine maker aims to break even by 2028. But that goal is contingent on convincing U.S. officials, who are led by longtime vaccine critic Robert F. Kennedy Jr., to approve shots for flu and norovirus, as well as a combination shot for flu and COVID-19.

The company expects potential approvals for its flu vaccine in several countries this year. But it doesn’t anticipate its flu shot will be widely available in the U.S. until 2027, Mock said. The U.S. is currently mired in a particularly bad flu season, with the current vaccines not well-matched to the circulating strain. Moderna says its mRNA technology can solve this problem because its vaccine can be more quickly updated.

Moderna’s disclosure came on the first day of the JPMorgan conference, where drugmakers often lay the groundwork for future deals. For months, Moderna has been seeking a financial partner to fund some late-stage vaccine trials. Mock said those conversations are ongoing.

(With assistance from Jessica Nix.)

©2026 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments