Econometer: Are Americans' household debt levels a major concern for the economy?

Published in Business News

Holiday spending was expected to be tempered this year but the latest data shows Americans aren’t slowing down, even with growing debt.

The National Retail Federation said nearly 203 million U.S. shoppers went to retail stores and websites from Thanksgiving Day through Cyber Monday — its highest in nearly nine years.

Some experts have expressed concern about growing credit card debt and burdens from other factors. U.S. household debt reached $18.59 trillion as of September, said the Federal Reserve Bank of New York, a record high.

Just how bad the debt situation is for the economy is up for debate. Some economists have argued the overall economy is still strong. They point to low unemployment as a reason why debts will be paid because money is still coming in.

Question: Are Americans’ household debt levels a major concern for the economy?

Economists

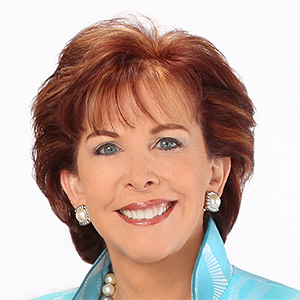

Caroline Freund, University of California-San Diego School of Global Policy and Strategy

YES: Household debt is a concern, especially as delinquency rates rise. Credit card and auto loan delinquencies are climbing to levels not seen since the Great Financial Crisis. The strain is concentrated among lower income households, reflecting the K-shaped economy, where the most vulnerable are falling behind. Delinquencies on big ticket items like cars are increasing especially rapidly among this group. With the job market becoming less certain, these trends point to growing economic risk.

James Hamilton, University of California-San Diego

NO: The latest data from the Federal Reserve Bank of New York shows that American households have added $4.4 trillion in debt since 2019. But there’s been a lot of inflation since then and our incomes today are higher. GDP increased by $9.2 trillion over those same five years. Measured as a percent of GDP, the real burden of household debt is actually the lowest it’s ever been since the New York Fed started reporting these numbers in 2003.

Norm Miller, University of San Diego

YES: Rising credit card debt at $1.23 trillion is moderately troubling, but the larger risks are the $1.73 trillion in student loans and weakened auto loan standards where delinquencies have climbed to 5%. Even more alarming, non‑bank lenders (i.e. Milo.io or Lendfriendmtg.com) are considering crypto‑backed mortgages, echoing the speculative credit that preceded the 1929 crash. As more lending shifts outside regulated banks and to volatile-priced collateral, the likelihood of another credit market meltdown increases.

Kelly Cunningham, San Diego Institute for Economic Research

YES: Discretionary spending now will be paid with interest by inflated dollars in the future, meaning future spending will be reduced by paying off debt while also paying inflated future prices for essential items. Although nominal debt is at an all-time high, adjusted for inflation, total debt remains below peaks during the 2008–2009 Global Financial Crisis. Household debt accounted for approximately 65% of nominal GDP in 2025, significantly lower than the peak of 85.8% reached in December 2008.

Alan Gin, University of San Diego

YES: The increased debt load is one result of a “K-shaped” economy. Those with high incomes are doing well; Moody’s Analytics reports that the top 20% of income earners accounted for 63% of consumer spending. Those at the lower end have been stressed by rising prices, particularly for necessities such as food and housing. That has reduced their purchasing power and forced people into increased debt. If job growth remains slow or even turns negative, many people could end up in bankruptcy.

David Ely, San Diego State University

NO: While aggregate nominal household debt is rising, so is personal income. Household debt service payments as a percent of disposable personal income is not at a worrying level and is well below rates experienced around the financial crisis, in 2005-2010. Loan delinquency rates are somewhat elevated and should be monitored. However, current household debt conditions are not so severe that they should be regarded as a major concern for the economy.

Ray Major, economist

YES: Debt is money that is spent before it is earned. Used properly, it’s not a problem. However, mounting debt on credit cards which now exceeds $1.23 trillion, is evidence that people are not able to pay their daily expenses without borrowing from their future earnings. At current levels, this is unsustainable for mid- and low-income families. Instead of building generational wealth by saving and investing money, they are mortgaging their futures.

Executives

Phil Blair, Manpower

YES: And always should be. My biggest concern is the ease and popularity of buy now and pay over many months for almost any product. It’s far too easy for impulse purchases rather than major planned buying. As with businesses in San Diego, cash/liquidity is king. Personal spending needs to be under control to protect against a potentially deteriorating employment picture and still very high interest rates.

Gary London, London Moeder Advisors

YES: The U.S. economy appears to be in decent shape, even as American debt levels are hovering high as a percent of GDP. The critical story is at the household level, and it remains statistically untold. Something is going on. There is bubbling discontent rooted in rising food, fuel and insurance costs, as well as mortgages and rents, among others. Job uncertainty is a festering factor. All of this is likely to play out in the polls next November.

Chris Van Gorder, Scripps Health

YES: Americans depend too much on debt to finance lifestyles that might not be supported by their income. I am not worried as much about recent increases in debt, as those increases seem to track inflation, but I am concerned about our overall reliance on debt and the things we use it for.

Jamie Moraga, Franklin Revere

YES: Americans are taking on increasing levels of household debt many cannot sustain financially. Low consumer sentiment contrasts with continued spending, revealing a disconnect that deepens financial strain and risk. With high living costs, inflation, stagnant wages, and layoffs, many households face mounting stress, limited savings, and uncertain retirement prospects. The so-called “resilient” consumer may ultimately reveal deep economic vulnerability and serve as a warning sign for long-term economic stability.

Bob Rauch, R.A. Rauch & Associates

YES: But the household debt levels themselves are not the problem. The combination of record balances, rising delinquencies, and demographic concentration of stress among lower- and middle-income families makes this a legitimate concern for the 2026 economy. It is not a crisis; a recession is not looming, but it is a headwind. Lower interest rates and inflation, reduced tariff impacts, tax reductions, and the World Cup will significantly benefit the economy. To a solid 2026!

Austin Neudecker, Weave Growth

YES: Elevated household debt and higher interest rates are squeezing budgets. Delinquencies on credit cards and auto loans are climbing. Debt payments impact categories like retail, services, and discretionary spending, which are substantial growth drivers. While low unemployment and anticipated rate cuts in 2026 are staving off negative consequences, we may be in a different situation if the labor market softens, charge-offs rise, or banks tighten credit. The economy isn’t collapsing, but elevated debt is now a clear risk.

©2026 The San Diego Union-Tribune. Visit sandiegouniontribune.com. Distributed by Tribune Content Agency, LLC.

Comments