Baltimore sues digital lender Dave, alleging the company misled borrowers

Published in Business News

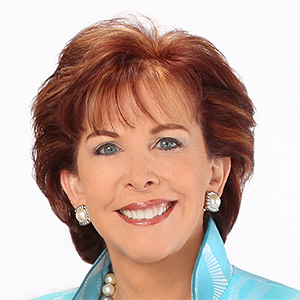

Mayor Brandon Scott announced Tuesday that the City of Baltimore has filed a lawsuit against digital lender Dave Inc., accusing the company of luring cash-strapped residents into high-cost, short-term loans through misleading marketing and interest charges.

Baltimore is being represented by the Baltimore City Department of Law and Berger Montague. Dave Inc. did not respond by deadline to a request for comment from The Baltimore Sun.

The lawsuit alleges Dave Inc. violated Baltimore’s Consumer Protection Ordinance by pushing its so-called ExtraCash Advances — marketed as “earned wage access” or “overdraft services” to distance itself from payday lenders, even though the advances do not provide overdraft protection and carry steep fees.

“This lawsuit, like others we’ve filed, is about protecting Baltimore residents, especially those most vulnerable to financial scams,” Scott said. “Dave’s business practices are intentionally designed to trap individuals in cycles of debt. It’s not just unfair; it’s illegal, and we’re committed to holding them accountable for the damage they’ve caused.”

City lawyers also say Dave Inc. encourages customers to leave optional “tips” — sometimes framed as helping fund meals for hungry children — while passing along only a fraction of those payments to charity. The lawsuit also alleges that Dave routinely charges interest well above Maryland’s 33% cap for consumer loans, in some cases more than 10 times that amount.

“Businesses like Dave take advantage of consumers experiencing financial hardship,” City Solicitor Ebony M. Thompson said. “My office will act to protect consumers who are being exploited.”

The latest in a series of lawsuits

The lawsuit follows Baltimore’s October action against another lender, MoneyLion Technologies Inc., as the city ramps up scrutiny of digital platforms it says profit from repeat borrowing. Baltimore alleged in that earlier lawsuit that MoneyLion also hid fees from users and had interest rates that exceeded Maryland’s APR cap. Baltimore also has pending lawsuits with DraftKings and FanDuel for what city officials say are similar unfair practices.

A recent study by the Center for Responsible Lending found that users of apps such as Dave and MoneyLion were more likely to incur overdraft fees after taking out their first advance, and that nearly three-quarters of users took out more than one loan within a two-week period.

©2025 The Baltimore Sun. Visit at baltimoresun.com. Distributed by Tribune Content Agency, LLC.

Comments