Ford's Q3 beats expectations, but Novelis aluminum plant fire lowers guidance

Published in Business News

Ford Motor Co. is lowering its annual earnings guidance for 2025 following a fire at a major aluminum supplier, but it plans to ramp up F-Series production in Michigan and Kentucky in 2026.

The Sept. 16 blaze at Novelis Inc.'s Oswego, New York, plant will cost Ford as much as $1 billion between this year and 2026, the automaker said. Although it recorded a $2.4 billion net income in the third quarter, and its earnings per share and record revenue beat Wall Street expectations, Ford lowered its adjusted operating profit guidance to $6 billion to $6.5 billion, down from the $6.5 billion to $7.5 billion it projected in July.

The Novelis fire has just been one of the latest challenges for Ford. Add it to President Donald Trump's new auto and parts tariffs, record recalls, a bloated cost structure, slower-than-expected electric vehicle adoption, and increasing global competition. And trade tensions with China soon could create semiconductor access challenges, too. But Ford executives underscored that the third-quarter results prove the company's business strategy is working, despite the obstacles.

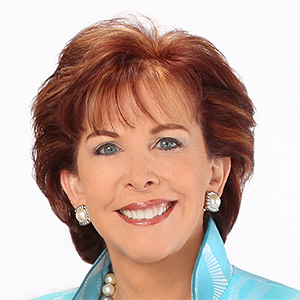

"Our business would have achieved around $8 billion in (operating profit) this year, at the very high end of the range we provided in February before tariffs," Chief Financial Officer Sherry House told reporters during a virtual briefing. "In fact, we would have raised guidance if not for the Novelis fire."

Investors responded positively to the results after market closure. Ford shares were rising up more than 4% to $12.85.

Novelis supplies roughly 40% of the aluminum sheet used in the U.S. auto industry, according to experts, and the aluminum-bodied F-Series pickups — which drive Ford's profit and are America's best-selling vehicle — use plenty of it.

Kumar Galhotra, Ford's chief operating officer, said Novelis' affected hot mill in New York is expected to be running again in late November or early December. Until then, the company will see production disruptions for trucks and SUVs with an expected $1.5 billion to $2 billion impact on fourth-quarter operating earnings. But with ample inventory, consumers shouldn't be affected, Galhotra said.

To recover lost production from the fire, Ford will increase its F-Series production volume by more than 50,000 trucks in 2026 starting in the first quarter. That includes 45,000 more trucks at Dearborn Truck Plant with a new third crew of 1,200 employees. Galhotra expects the crew will last for "quite a bit" with recovered production happening over the course of next year.

Elsewhere at the Ford Rouge Complex, the company will add 90 employees at Dearborn Stamping Plant and 80 employees at Dearborn Diversified Manufacturing Plant to support the increase.

Hourly employees at the Rouge Electric Vehicle Center will transfer to Dearborn Truck as all-electric F-150 Lightning production remains paused to prioritize the gas-powered and hybrid F-150s that are more profitable and use less aluminum. The decision comes as Ford CEO Jim Farley expects U.S. EV demand to halve following the end of a federal plug-in vehicle tax credit. It's unclear for how long Lightning production will be down.

"We're 100% focused on F-150, getting it back together and recovering as much as possible," Galhotra said. "The plant is right there next to DTP, so whenever we're ready, we'll crank the REVC back up."

Kentucky Truck Plant also aims to increase its F-Series Super Duty assembly line speed by one job per hour with the addition of more than 100 employees. Ford will invest $60 million in the site for training and other efforts to increase the line speed.

The company has said it will begin Super Duty production in 2026 at its idled Oakville Assembly Complex in Ontario, as well. But with President Donald Trump imposing 25% tariffs on non-U.S. content of vehicles imported from other countries, including Canada, executives have said that plant will focus on the Canadian and other international markets.

Ford's third-quarter net profit was up 167% year-over-year after the period a year ago was hit by one-time charges related to canceling an all-electric three-row SUV program that had been slated for Oakville.

In the July-through-September quarter, Ford's adjusted operating income was $2.6 billion — flat year-over-year. Adjusted operating profit margin was 5.1% compared to 5.5% a year ago on record revenue of $50.5 billion, which was up 9% from the same period in 2024.

On average, analysts were expecting revenue of $43.86 billion and earnings of 36 cents per share, according to Yahoo Finance. Ford recorded adjusted earnings per share of 45 cents for the quarter.

The Dearborn automaker now expects the import taxes will affect adjusted operating profit by a net of $1 billion this year compared to $2 billion it forecasted in July. House attributed this to the expanded parts tariffs offset program that Trump expanded on Friday and which is retroactive. Its guidance puts its annual operating income at $6 billion to $6.5 billion compared to 2024's $10.2 billion results.

Although Ford builds more vehicles in the United States than any other automaker and 80% of the vehicles it sells here are assembled here, it faces duties on parts to build its trucks and SUVs, though the Trump administration has made changes to offer some relief for U.S. manufacturers.

Because of tariff uncertainty, Ford in May suspended its guidance for an adjusted operating profit of $7 billion to $8.5 billion that it provided in February. The net effect of tariffs in the first half of the year was roughly $1 billion with an additional $700 million in the third quarter — but this will be reduced from the expanded offset program, House said. Ford is predicting a 36% to 41% profit decline from 2024.

Farley was in Washington, D.C., this week over concerns about microchip supply. China's commerce ministry earlier this month blocked Dutch-based Nexperia from exporting chips from China after the Netherlands government took control of the company and removed its Chinese CEO, citing concerns over technology appropriation. China had placed the company on a restricted export list.

Nexperia makes common parts, and Ford is stocking up on all it can buy, said Galhotra, who also conveyed optimism about a solution to the situation.

"The run-out dates look very close to the date when there's potentially a resolution on the horizon." he said. "We believe that a very quick breakthrough is necessary to avoid fourth-quarter production losses, not just for us, but for the entire industry."

Ford's U.S. sales climbed 8.2% in the third quarter and were up 7.2% through September. Ford offered discounts previously reserved for employees to its other customers from early April through the July 4 weekend, contributing to a 7% year-over-year increase in U.S. sales in the first seven months of the year. Through Labor Day, it offered zero down payment, zero percent interest for 48 months and zero payments for the first 90 days on most Ford and Lincoln vehicles.

The automaker also benefitted from increasing EV demand as consumers took advantage of the federal plug-in vehicle tax credit before it expired. With that gone, the EV market is expected to be a bumpier one. Ford in August announced a $2 billion investment to retool Louisville Assembly Plant to produce an all-electric midsize truck starting at $30,000. Ford expects $9 billion in capital expenditures in 2025.

Quality problems also have plagued Ford this year. The Blue Oval has issued more recalls so far this year than any automaker has in a full year, totaling 127. Chrysler parent Stellantis NV is the next closest with 41 recalls in 2025. House said vehicles rolling off the line today show improved quality. The automaker also is on track to cut $1 billion in costs this year.

Ford Blue, the company's internal combustion engine and hybrid vehicle business, posted operating income down 5.2% to $1.54 billion. Its 5.5% operating margin was down from 6.2% a year ago.

Ford Pro, the commercial vehicle business, reported $1.985 billion in operating income, up 9.5% year-over-year, and an 11.4% operating margin compared to 11.6% a year ago.

The loss posted by Ford Model e, the business unit dedicated to electric vehicles, was $1.41 billion compared to $1.231 billion in the third quarter of 2024.

The company didn't provide updated guidance for its three divisions. In May, it suspended predictions for operating earnings in Ford Blue of $3.5 billion to $4 billion and in Ford Pro of $9 million. It also had predicted a $5 billion to $5.5 billion loss for Model e.

Adjusted free cash flow was $4.3 billion, and it predicts the measure for 2025 will range from $2 billion to $3 billion, down from $3.5 billion to $4.5 billion because of aluminum production disruption. At the end of the quarter, Ford had $33 billion in cash and $54 billion in liquidity.

Ford will pay a 15-cent dividend on Dec. 1 to shareholders of record on Nov. 7.

On Tuesday, General Motors Co. beat Wall Street expectations for the third quarter, recording a $1.327 billion net income that was down 57% year-over-year. Still, it upped its expected adjusted operating profit to $12 billion to $13 billion for 2025. Stellantis will report third-quarter shipments and revenues on Oct. 30.

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments